So, you have a lot of experience with cryptocurrency exchanges and have been flipping coins for a while.

You’re comfortable with the process of buying an asset at one price point, selling it elsewhere for profit, then holding what you made until prices allow you to do the same thing again. This is arbitrage trading.

But maybe your friends keep talking about Arbitrage bots that can mysteriously make money on their own without human intervention. Perhaps they say that these bots are extremely profitable! If someone has time to play around with software like this, why would they need another trader working in tandem with them?

Doesn’t it make more sense to just let machines handle this? Then again, how easy could it really be to code something like this? Let’s find out!

What is Arbitrage Trading?

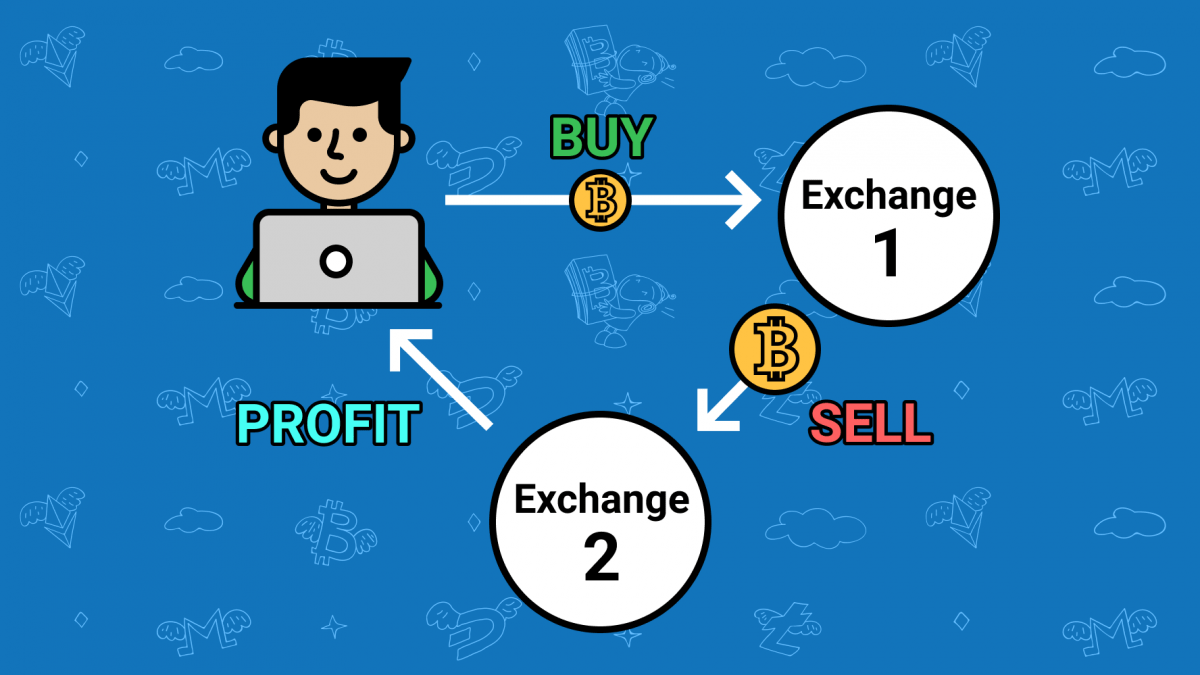

Arbitrage trading is the process of taking advantage of a price difference on different cryptocurrency exchanges. The goal is to buy low on one exchange and sell high on another – maximizing your potential profit by making two trades instead of just one

. For example, there might be a coin that’s selling at $8500 BTC on Exchange X but just $8600 BTC on Exchange Y. If you have money in both accounts, you could perform an arbitrage trade that nets you 1% or about .04 BTC. Note however that this percentage will vary over time as the prices change so if the price jumps to $8655 BTC on Exchange X, your 1% yield will now be .0345 BTC instead of .04 BTC.

You need to decide if you need to use a bot to trade for you instead of doing it yourself. HINT: usually, you will if any of these are true:

• You’re new to trading,

• You don’t have time to trade manually, or

• You lack the programming skills required to code a bot.

At this point in cryptocurrency history, bots can do basically everything that humans can so there is no major advantage for doing it manually anymore unless you’re just trying to learn how crypto exchanges work and what they like on the backend. Most people who trade manually do it because they can’t or don’t want to use a bot and just prefer the platform that the exchange provides.

It depends on your particular reasons for trading whether you should be using a bot or not. For example, if all you want is to make money as quickly as possible, then having someone program a bot for you to do it will probably result in more profit over time.

However, if you’re trying to learn how exchanges work or are partial to your existing exchange’s UI, manual trading still has its place! We would only recommend trading manually if you really need two things:

Do you know what kind of trades other bots make but don’t find them personally appealing – To take advantage of profit opportunities bots make, you will need to use a programmer who writes their own bot from scratch.

If you don’t really care about how the trades are made but just want to make them, then you can use any of the more novice-friendly trading bots that come with their own GUIs and don’t require writing code. If you want to learn more you can check resources like this app.

You have a high degree of patience

To manually trade successfully, your knowledge of cryptocurrency exchanges and experience with arbitrage must be very thorough or else you won’t know when opportunities arise! This requires a lot of work and study if done properly. If you’re not willing to put in this level of dedication, hiring someone to program a bot for you is usually better.

Break down the pros and cons of using a bot to perform crypto arbitrage trading for you.

Pros:

-It’s a profitable, low-risk way to make money using your crypto assets + programming skills

– A better worker – a bot doesn’t sleep, eat, drink or take time off and is fully dedicated to trading 24/7

Cons:

– The need for a very specific type of programming know-how that most people don’t have (and can’t learn from guides online alone)

– Your bot might not always be as profitable as you’d like if it performs worse than other bots on the market or fails at trading certain coins due to their technicalities or lack thereof. In this case, you would probably want to hire someone else who writes better bots so you can compensate for the bad trade with a good trade.

– If your bot fails, you’ll lose about 70% of the initial investment in it since you will have to start over from scratch

Determine if you should use arbitrage trading bots that are free or paid for

Since it takes so much time and works to program even the most basic arbitrage trading bots, they are rarely made freely available by their developers online due to them being highly sought after. However, if you do find one that’s close enough to what you want for free, it’s definitely worth trying out! It might not perform as well as paid ones but at least it won’t cost anything either!

Even though they’re not optimal or guaranteed to be profitable, they can still give you the opportunity to test whether or not arbitrage trading is right for you. That being said, if you have the capital available, it’s usually better to buy a professional bot that performs well instead of wasting time trying out free ones.

It may seem like an unnecessary expense but again, this is your money which you worked hard for. If you’re going to use it to make more money in the long run then why not invest in something that could work wonders? You don’t want to buy expensive assets only for them to lose value through no fault of your own!

Conclusion

For people who are new to cryptocurrency exchanges and/or do not know how they work, we would definitely recommend using bots programmed by experts or professionals.