Every business is exposed to different types of risks, so it is crucial for business owners to purchase different types of policies to take care of these risks. It may be a good idea to consult a business expert to assess all the risks your business may be exposed to. Once you have identified those risks, you can look for a suitable insurer and insurance policy for your business.

Types of Business Insurance Policies

1. Property Insurance

Every asset owned by your business needs to be insured. This includes furniture and fitting, inventory, computers, stationery, and all other types of valuables that may be owned by the business. In case of fire damage, storm damage or theft, property insurance will help to ensure that you are properly compensated for your losses.

2. Commercial Vehicle Insurance

If you own one or more commercial vehicles or you have leased a number of these vehicles, you have to purchase commercial vehicle insurance. In case of damage or theft, you will be compensated for your losses.

3. Public Liability Insurance

Smart Business Insurance may be able to provide insurance that may protect against lawsuits. If an employee slips and falls on your property, they can decide to file a lawsuit against you. In the litigation-happy society we live in, even unmerited lawsuits can be decided in favor of the plaintiff. As a result, you may be ordered to pay a significant amount of money.

Fortunately, public liability insurance can pay the legal costs associated with these lawsuits as well as the settlement awarded by the court. The ideal public liability insurance policy should cover bodily injury and property damage among other types of liabilities that may arise.

4. Errors and Omission Insurance

Whether you are in the services or tangible goods business, you have to purchase errors and omission insurance to protect your business from liabilities that may arise from errors and omissions you may commit. The importance of this type of insurance cannot be overstated, so be sure to purchase a suitable smart business insurance that has this coverage.

5. Workers Compensation Insurance

This is not only an important insurance policy for businesses, but also a legal requirement. Every eligible employer needs to enroll all eligible workers to the workers compensation insurance scheme and pay the necessary premiums. If you fail to meet these two legal requirements, you may attract financial and legal sanctions.

The scheme protects not only workers, but also employer from lawsuits. Workers can be assured of getting full medical coverage as well as wage replacement benefits. This means that in case of a work-related injury, you will not be sued by the injured worker. You will also not pay for their treatment or wage replacement benefits as the scheme will take care of this.

Buying Business Insurance Policies

As you can see, every business needs different types of liability protection. This means that you will have to purchase different types of policies to ensure that you are properly covered. Since there are many insurance companies out there and they may all claim to be better than the rest, it is recommended you carry out a little bit of research to identify the best policies for your needs. In this regard, the following are key factors to be taken into consideration during the search:

1. Premiums

This is perhaps the most important factor of consideration when searching for a suitable business insurance policy. After all, you want to minimize your business expenses. Since there is plenty of competition out there, it is recommended you shop around. Consider consulting a business insurance broker as they can help you search for a policy that fits into your budget. That said, you should not make your decision based solely on the premiums charged by an insurer.

2. Coverage Limits

When analyzing the policies offered by different insurers, it is recommended you pay attention to the coverage offered by each policy. The coverage limits also matter a great deal. After all, a liability may be covered, but only partially, so you need to confirm that a policy offers sufficient protection. Once you have identified policies that provide sufficient coverage, you can start considering other factors.

3. Exclusion Clauses

The terms and conditions that come with a policy are usually hidden in the policy document using technical words and plenty of legal jargon. It is important you read these conditions to identify all the exclusion clauses. After all, the policy may offer superb liability protection, but the exclusion clauses can make the policy useless for your business.

Now you know why business insurance rates need to be compared. Before you purchase any type of policy for your business, therefore, be sure to exercise patience as you conduct your due diligence as this can help you make informed decisions. The following are simple steps to be followed when comparing smart business insurance rates:

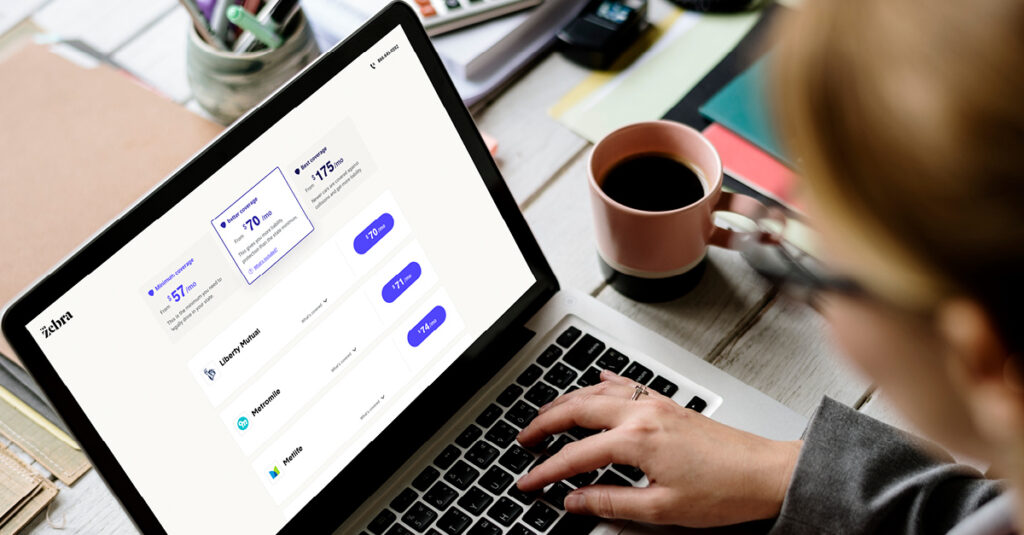

Step 1: Request Quotes

The first thing you need to do is ask the top-rated insurers to give you their quotes for the type of coverage you require. Obviously, you will need to provide these insurers with details about your business operations and what you want.

Step 2: Compare Quotes

Once you have the quotes, the next step is to compare them. Do not just look at premiums when comparing policies; you also need to look at what these policies cover. The coverage limits should also be checked. For instance, if you are looking for vehicle insurance, make sure that underinsured and uninsured motorists are covered under the policy. The coverage limits should also be checked to ensure they are sufficient. After all, you do not want to spend your limited capital to pay medical bills for injured uninsured or underinsured road users.

Step 3: Consult a Broker

Insurance brokers have resources that make it easy for consumers to compare business insurance premiums. Therefore, it is recommended you look for a reputable independent broker to help you with the search for a suitable smart business insurance policy that meets all your coverage needs.