Stock trading apps allow you to trade stocks, manage your portfolio and more from anywhere. These apps are available for both infrequent traders and those who trade every day.

Stock trading apps that are the best for beginners and professionals have great features. They can help you achieve your trading goals, provide customer support, and allow you to transfer funds from your bank account to your brokerage account. These apps are affordable and provide a broad range of trading assets.

The Best Stock Trading Apps for 2024

1. Best Overall – Exante

- Best Overall: Exante broker

- The Best for Beginners: Fidelity

- The Best Free App:Webull

- Best for Learning About Trading:SoFi

- Best for Options Trade:tastyworks

- Best with Banking Products:Ally

Pros

- Advanced and beginner mobile apps

- You can access support for many assets and account types

- Research resources for extensive use

Cons

- Minimum Deposit: 10 000 EUR

Overview

Exante is the best because it has everything for everyone and great pricing. For casual stock traders and beginners who need to keep track of their investments while on the move, the basic Exante Mobile App is a great choice. The upgraded app is for advanced and experienced traders. It offers a professional-like experience.

Access to both apps is available to TD Ameritrade clients who have a brokerage account. There are no minimum balance requirements or fees for trading stocks and ETFs. The fully-featured apps offer both trading and account management functions.

The Key Features

- App names EXANTE

- Account minimum: 10 000 EUR

- Tradable assets – Wide selection, including options, stocks, ETFs and mutual funds. Bonds are also available.

2. Fidelity is the best choice for beginners:

- Deposits:No minimum deposit

- Fees$0 commissions on stock, ETF and options trades. However, there is a flat fee of 65 cents per option contract. Broker-assisted trades are $32.95; transaction-fee mutual funds are $49.95. There are no recurring fees; additional fees may apply.

- Account Types -Supports brokerage and retirement accounts.

Why We Choose It

Fidelity is the best choice for beginners because it has no minimum deposit requirements and intuitive screens.

Pros

- Traders need both trading and investment features.

- You can access support for many account types

- Research extensive and educational resources

Cons

- There are very few advanced charting options

Overview

Fidelity is the best brokerage for beginners and anyone who wants to invest in long-term and retirement. Fidelity offers full-service with many investment options and account types. You get many services for a very low price, including ETF and stock trades starting at $0

Fidelity Investments, Fidelity’s Android, iOS and Amazon app, is Fidelity’s Android, iOS, or Amazon-compatible app. You can manage your Fidelity investments accounts and trades. Although it doesn’t offer as many advanced charting options as other mobile apps, this is fine for beginners who don’t want or need them.

The Key Features

- App Name: Fidelity Investments

- Account minimum: No minimum deposit required

- Fees – There are no commission fees on stock, ETF and options trades. However, there is a flat fee of 65 cents per option contract. Broker-assisted trades cost $32.95; transaction-fee mutual funds cost $49.95. Most accounts have no recurring fees. Additional fees may apply.

- Tradable assets Stocks, ETFs and mutual funds. Fractional share investing is also available.

- Account types – Supports retirement, education, and brokerage accounts.

- Additional important details : Intuitive screens for entering trades and tracking performance. Social media-style feeds of customized account and investment information.

3. Webull – The Best Free App

- Deposits:No minimum deposit

- Fees$0 commission and contract fees for online stock, ETF or options trades; $8-$45 wire transfers; additional fees might apply

- Account Types -Brokerage, IRA accounts

Why We Choose It

Webull is a free platform that accepts no commissions. It has no minimum deposit requirements and offers generous stock promotions to new users. This makes it the ideal choice for the best app.

Pros

- Platform-wide, no commissions

- Virtual currency trading is also available through paper trading

Cons

- Only a few assets available

- Limited customer service options

Overview

Webull is a tech-centric trading app, which is best for stock traders who have at least some experience. Although Webull doesn’t have a lot of educational content, it is packed with many useful features. Expert traders and active traders alike will benefit from advanced charting and optional add-ons to provide more detailed quote data.

You might expect a higher price for all these advanced features. Webull is nearly free to use. Trades made on the app are free of commission, and include stocks and ETFs. The app allows you to trade stocks and ETFs. Although cryptocurrencies are relatively new, you won’t be able to find bonds, mutual funds or any other assets on the platform. Although Webull is newer than the majority of other apps on this list it still has many features that can be used by active stock traders.

The Key Features

- App Name: Webull Stocks, Options & eTFs

- Account minimum: No minimum deposit required

- Fees – $0 commission for options, ETF or stock trades online; $8 to $45 wire transfers; additional fees could apply

- Tradable assets Stocks, ETFs and options.

- Account types – Supports brokerage accounts and IRA accounts

- Other important information

4. SoFi – Best for Learning About Trading

- No minimum deposit required. However, you can start investing with $5

- Fees No fees for online stock and ETF trades. 1.25% markup on crypto transactions. Expense ratios may vary on SoFi ETFs. Additional fees may apply

- Account Types Supports self-directed portfolios and managed retirement accounts, as well as cryptocurrency accounts

Why We Choose It

SoFi provides robust tools that will help you learn about stocks and then put them into action on the same app.

Pros

- Low fees

- Trade fractional or full shares easily

- Member events

Cons

- Tradeable assets are limited

- There are a few types of accounts

Overview

SoFi is shorthand for Social Finance and offers loans, investments, and banking through a mobile app. This app is ideal for stock traders who want to learn more about trading stocks. This brokerage allows you to trade commission-free and receive fractional shares. There is no minimum balance or $5 required to invest.

The app’s Learning section contains articles that can be used to help beginners manage their accounts.

The Key Features

- App Name: SoFi Investment, Money, Loans

- Minimum Account: $5 minimum to begin investing

- Fees : There are no fees for trading online stocks or ETFs. However, there is a 1.25% markup for crypto transactions. The expense ratios of SoFi-branded ETFs may vary. Additional fees could apply.

- Tradable assets Stocks, ETFs and cryptocurrencies, fractional share

- Account types – Supports self-directed portfolio management, as well as retirement and cryptocurrency accounts

- Additional information: SoFi offers loan products as well as cash management accounts. It is a simple, clean and intuitive app that can be used by beginners.

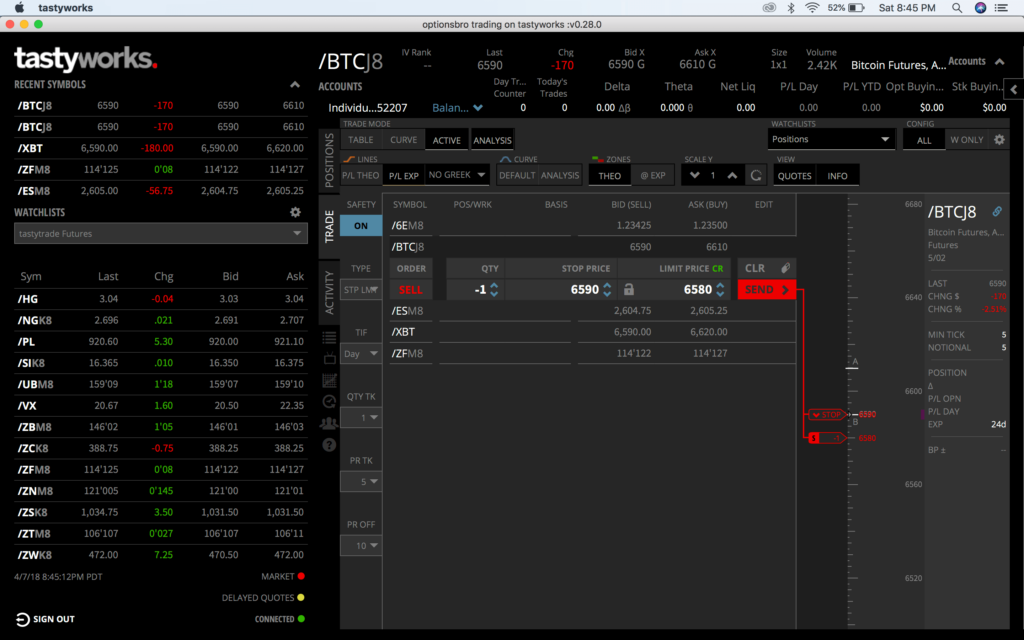

5. Tastyworks is the best for Options Trading:

- Deposits:No minimum deposit

- Fees No fees for stock or ETF trading; $1 per option with stocks or ETFs; $10 maximum; $2.50/option on futures; 1.25 per futures contract, $0.85 per futures micros contract; additional fees possible

- Account Types -Individual or joint margin cash accounts, retirement, corporate, trust and international accounts

Why We Choose It

Tastyworks is our top choice for options trading due to its unique features and features, as well as the capped fees.

Pros

- Options trades subject to caps

- Options trading features

- For trade ideas, follow community members

- There are many account types that can be used

Cons

- It is not the most affordable per-contract fee

Overview

Although tastyworks may not be as well-known as some of the largest brokerage firms, it’s still a top choice for what it does. The app is extremely focused on options trading. Although these aren’t shares of stock, many options can be traded based on movements in stock prices. So tastyworks deserves a mention.

Fee-free trading of stocks and ETFs is possible. Stock and ETF options cost $1 per contract, with a maximum of $10 per leg. Mobile traders who have some trading experience are best because there are many features that could distract or overwhelm newer traders. tastyworks offers essential features that options traders need to trade quickly without sacrificing many desktop trading features.

The Key Features

- App name: tastyworks

- Account minimum: No minimum deposit required

- Fees : There are no fees for ETF or stock trades. $1 per option on stocks and ETFs with a maximum of $10; $2.50/option on futures; 1.25 per futures contract; $0.85/e-micros futures contract. Additional fees may apply

- Trading assets: Options to purchase stocks, futures and ETFs

- Account types : Individual and joint margin cash or cash accounts. Retirement, corporate, trust and international accounts

6. Ally – Best with Banking Products

- No minimum deposit

- Fees$0 commission for online stock, ETF or options trades. However, there is a flat fee of 50c per option contract. $20 plus a regular commission fee for broker-assisted trading; $9.95 for mutual funds with no load; additional fees may apply

- Account Types Supports portfolio management and self-directing

Why We Choose It

Ally is our top choice for the best app that integrates with banking products. It gives you access both to your bank accounts and your trading account through one platform.

Pros

- One app that allows you to combine your bank accounts and investments

- Stock trades that are easy to use

- It’s simple to use, manage and is easy to understand

Cons

- Limited mobile app research

- Trading tools may be too complicated for some advanced traders.

Overview

Ally offers high-quality checking and savings accounts, as well as investment accounts. Although you can get bank accounts through other brokers, Ally Bank offers the best online savings and checking services regardless of your investment goals. You get a winning combination of a bank and investment when you add in the cost-effective, easy-to use brokerage accounts.

Ally does not charge commissions for ETF or stock trades. Although charts and data are not very complex, they offer everything a beginner investor might need. Although it doesn’t have the most advanced features, it provides all of the necessary information at an affordable price.

The Key Features

- App Name: AllyMobile: Banking & Investing

- Account minimum: No minimum deposit required

- Fees – There are no commission fees for online stock, ETF or options trades. However, there is a flat fee of 50c per option contract. $20 for broker-assisted trades. $9.95 for mutual funds with no load. Additional fees may apply.

- Trading assets: Stocks and ETFs. Options, bonds and mutual funds.

- Account types – Supports self-directed portfolios and managed accounts

- Other important information Full-service online bank and brokerage without physical location

Final Verdict

You have many options when choosing a stock trading application. Some companies offer low fees while others provide beginner-friendly platforms. Overall, EXANTE trading app is the best. It’s easy to use and has both a platform for beginners and a separate platform that is for advanced traders. You don’t need to have a minimum balance and it has reasonable fees.