Arbitrage opportunities are increasingly becoming the go-to strategy for traders who want to make a quick buck in the securities market. Although the concept of arbitration spawned from traditional markets, traders are now applying the concept to cryptocurrency and making lucrative profits.

Arbitration, like any other trading strategy, has its advantages and pitfalls. However, before we outline the way you can benefit from cryptocurrency arbitrage, we must delve into the concept and establish a basic understanding.

What is Cryptocurrency Arbitrage?

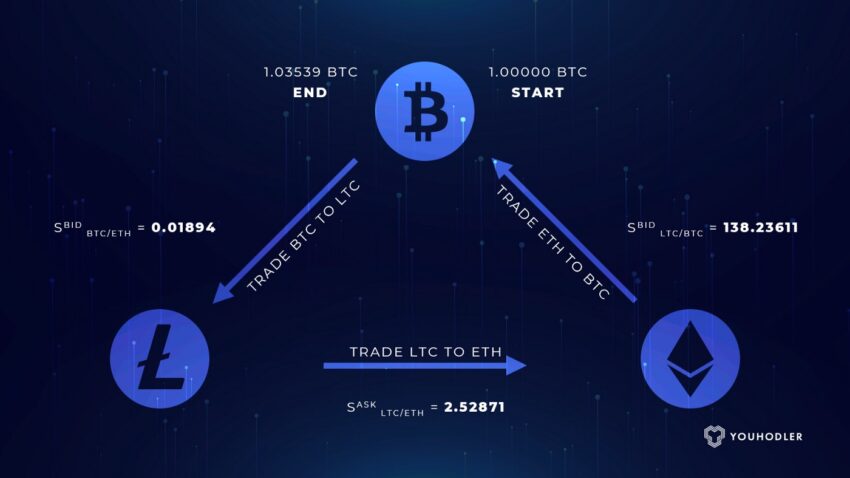

The term cryptocurrency will require no introduction to individuals who have made it so far in the article. However, what exactly do we mean by arbitrage? Arbitration in exchange markets refers to the technique of buying securities or digital assets in one market and immediately selling them in another at a higher price.

The price difference between the acquisition and the sale of the asset will determine the trader’s profit. As a result, cryptocurrency arbitration refers to the acquisition of a digital asset in one market with the intention of selling it in another at a higher price.

To substantiate, here’s an example to help individuals understand the concept better.

For instance, Bitcoin is traded on several exchanges. However, on a more fortunate day, an arbitrageur notices that Binance is selling Bitcoin for $54,000 while Coinbase has a listed price of $54,675. As a result, the arbitrageur will spare no expense and buy as many Bitcoins they can from Binance and sell it at a higher price on Coinbase.

Although the difference quoted here is $675, which is a lot when it comes to making profits from arbitration, several arbitrageurs leap at investment opportunities that reflect a price difference of even cents. The chance to capitalize on price differences can make a massive difference if you can acquire cryptocurrencies in a significant volume since the price differential will eventually amount to a considerable figure.

Here’s how you can benefit from Crypto Arbitrage

1. Select a Crypto Arbitrage Bot

You cannot possibly master everything there is in the vast world of cryptocurrency. As a result, try leaving a few things to bots and relax a little. When it comes to arbitration, you must be quick to spot price differentials to make profits.

However, we understand that you are a human, and comparing prices across exchanges can lead to missed opportunities. Therefore, letting a bot do all the grunt work while you execute transactions is what you must do to benefit from crypto arbitrage.

Successful arbitration deals are very challenging to spot. Consequently, choosing software to cull out deals such as the one available on the website Bitcoin Revolution can help you immensely in realizing profits like never before.

You can make a real fortune in the cryptocurrency industry if you start today, and Bitcoin Revolution is a website that can help you with so much more than just crypto arbitrage. Therefore, check it out today and begin your journey to ultimate riches!

2. Choose High-Speed Transaction Cryptocurrencies

If you are looking to transfer funds between exchanges, ensure to choose cryptocurrencies that have a high transaction speed. Arbitration is all about the timing, and if you squander those precious seconds on delayed transactions, you might miss making a fortune eventually. As a result, choosing a cryptocurrency that guarantees high transaction speed can help you realize profits and deviate from the mainstream market.

Individuals who choose to arbitrate Bitcoin will encounter high traffic during transaction approval. Bitcoin is one of the most popular cryptocurrencies. The speed at which a transaction is approved depends on how many miners are up to the task and what fee you are offering to make the transaction approval their priority. The higher the transaction fee you quote, the more quickly your transaction will get approved.

However, transferring money among exchanges will be a frequent story during crypto arbitrage, and you cannot afford to lose funds to get your transactions approved. As a result, choose coins that have not gained the spotlight yet and are still available for arbitration. That way, your transactions will get approved more quickly and at a cheaper rate.

3. Choose Exchanges with a reliable User Interface

If you are not able to navigate yourself on an exchange, you will lose the time necessary to execute the transaction. As a result, always choose an exchange that you can trust and has the necessary security code in place to protect your funds, and is easy to navigate. Individuals who are new to the concept must first acquaint themselves with the quirks of different exchanges before executing real-time transactions.

You can also verify the security of the wallets different exchanges offer. Your funds will always be at risk if you are storing them in hot wallets for longer periods.

As a result, if push comes to shove and you have to utilize a hot wallet to store your funds, choose a cryptocurrency exchange that is reliable and has not been the victim of any malware attacks. Apart from this, look for additional security features to protect your funds and do not keep them in the same place for a very long period.

Conclusion

Although there are a few risks that arbitrageurs experience when transferring cryptocurrencies, the technique is one of the most sought-after by traders who want to make serious money. However, the last note on crypto arbitrage from our end would be that traders must be aware of what they are getting into and the risk of storing cryptocurrencies in hot wallets (wallets provided by cryptocurrency exchanges).

Since arbitrageurs are required to transfer money quickly, they will have to store their assets in the wallets provided by cryptocurrency exchanges. However, such wallets are prone to malware and phishing attacks occurring online. Therefore, always make sure that you have read the security guidelines of the exchange you are choosing to trade on and whether it has been the victim of any malware attacks.