Knowing about some of the leading business requirements is essential if you are interested in starting trading in the forex market. First of all, you should have a thorough understanding of trade and basic trade strategies in the field.

Besides, it is helpful to follow an economic calendar on Fastbull to get an idea of the significant upcoming events. There are several practical trading tools for beginners in the forex industry. Let’s analyze some of such helpful tools for beginners in this article.

1. Charting Platform

There are several ways of analyzing the market for better understanding the mood and trend of the market. Some investors use technical analysis for making a correct call, while others use fundamental analysis to predict the market trends.

It is also good to go for a weekly study to understand the progression of your strategies in the market. Based on the analysis, you can make corrections to your plan and prepare better for the week ahead. Finally, it is good to use a charting platform to gauge the market mood correctly if you do technical analysis. There are many charting platforms available in the market.

You have to pay for the more professional options, but free versions are also available. You can get good info on carting platforms and their ratings from credible websites. The traders can use the charting module of the trading platforms for technical analysis.

2. Forex News

A lot of factors affect the performance and volatility of the forex market. Like all financial markets, news related to global economic events like the announcement of GDP numbers, inflation figures, jobless data, export details, etc., can affect the markets’ performance.

Some unexpected events could hit the forex market, but at the same time, many of the events, including GDP figure announcements, are already notified on the calendar. Sensible investors will plan their move according to the events in the calendar.

Depending on the trend, they can decide whether to hold, buy or sell currencies from the market. They can read the impact of particular news on the market and plan their future moves accordingly. You have to keep a regular watch on news events if you are interested in dealing with intraday trading.

3. Economic Calendar

Good traders use an economic calendar to plan their weekly trades. They are sure of what to expect from the market and the critical economic events that can potentially impact the market. Beginners in the forex market will get many economic calendars, and the effective use of such tools can better boost your understanding of the trade.

Some platforms offer economic calendars on their apps, and investors can download such apps to track major economic events in the world. They won’t miss important news updates related to forex markets in such a scenario.

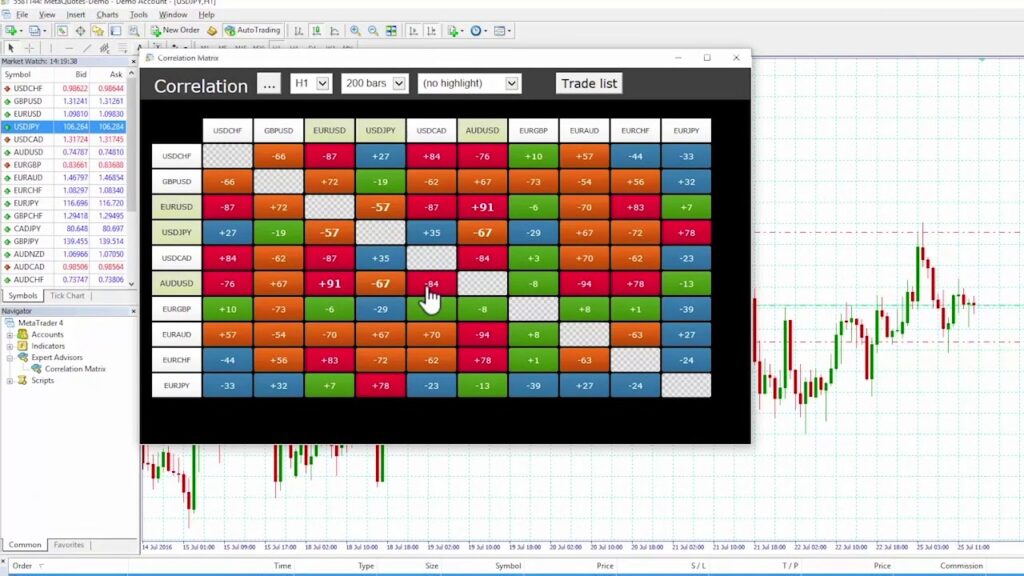

4. Correlation Matrix

The beginners can use a correlation matrix to understand new trading opportunities in the market. It gives an indication to you about the correlation between different currency pairs. When the US dollar is performing better, you can see all currencies using the dollar as the base currency going up.

You can find a correlation matrix on good forex-related websites. You can use the matrix data to have the upper hand in technical analysis.

5. Websites

If you want to be a successful trader, you regularly read good financial websites. Good financial websites will provide you with all the information related to market movements. A beginner should understand the prevailing trend from a financial website.

The experts will also give some valuable tips about the upcoming trading opportunities. So, financial websites can be considered a beneficial tool for all beginners. You can follow important financial news websites such as Bloomberg.com, CNBC.com, etc.

6. Trading Journal

You should maintain a forex trading journal from the start of your business. It will give an idea about your successful trades and how you approached them. Similarly, you can understand what went wrong with some of your trading decisions.

When you have experience in the market, you can formulate a trading strategy on your own based on your past trading. You can look at your trading journal to get inspiration for future business. You can create a trading journal in an excel sheet or a word document.

7. Forex Forums

We already understood that it is essential to read financial websites to get insight into trading. Similarly, you can join some good forex trading internet forums and join the discussions related to forex trading. You can get some good tips and strategies from such meetings.

In addition, you will get an idea about the new trading platforms and software. However, you shouldn’t blindly follow the trading strategy of another investor. What would be suitable for another investor might not be helpful for you.