With all decisions, there’s a risk, and that’s true of finances and investment. Some investors choose to be cautious, protecting their wealth by being safe. Others take their chances in an effort to get the most significant returns to grow that wealth for the benefit of their future.

There is a happy medium. When using risk management advisory strategies, the investor can accept the risks to take advantage of higher returns but stay within an acceptable boundary, sort of stepping a foot outside the comfort zone but wearing protective shoes.

The priority is to achieve a portfolio with holdings that will eventually work to accomplish investment goals leading to a successful future. How will risk management assess for tolerance, and what strategies are ideal in managing risk? Let’s learn together.

What Are The Fundamentals Of A Good Risk Management Advisory Strategy

When using a risk management advisory strategy, assessing tolerance is primary. Learn the importance of risk assessment at https://www.investopedia.com/articles/investing-strategy/082916/importance-clients-risk-assessment.asp. The indication is there are three components when making this determination. These include:

- Capacity: The amount of loss the investor can tolerate financially without it affecting their overall security. There are variables to consider like the investor’s financial goals and its timeframe plus the client’s age,

- Needs: What will the returns need to be to achieve the goals?

- Emotional: Some investors become emotional, making irrational decisions with assets based on those reactions causing worse problems than initially. That isn’t easy to assess until the behavior occurs.

Risk management is essential for numerous reasons but primarily because it can help to protect wealth when times are difficult and allow for greater returns when things turn around for the better. Open here for guidance on risk profiling. The ideal strategies to use for managing portfolio risk:

-

Assessing for diversification

Wealth should be spread throughout several asset classes to stave off potential damage during a crisis. If there’s a loss with one holding, the others could carry on without seeing as much turmoil.

That might mean an investor considers stepping outside the stock and bond realm and venturing into alternative assets. Some choose physical commodities, options that don’t correlate with the markets.

When a portfolio is heavy in one specific class, perhaps it’s stuffed with “paper” that’s dependent on the stock market doing well; there can be substantial damage if the market dips. Given the history of the stock market and its tendency to fluctuate, sometimes drastically, investors are wise to step outside these confines.

-

Reducing volatility

Allocating some form of cash percentages can help decrease portfolio volatility, potentially preventing the need to sell holdings when times are tough, creating a loss when the market dips. How much cash will depend on goals and the timeframe an investor sets to accomplish those goals.

If an investor’s wealth is abundant in cash long-term, the growth potential could be diminished based on inflation.

-

Invest with consistency

Some investors hope for rapid returns. That would mean that you are instinctive and know precisely which stock to buy at the exact moment and when you should sell it.

A strategy referred to as “dollar-cost averaging” differs in that it requires a regimented approach, being patient, and looking further down the road. It allows you to avoid the emotional reaction that often causes impulsive decisions that damage portfolios creating the potential for significant loss.

With this strategy, you will regularly contribute each month, bi-monthly, a specific amount to a designated investment account. These funds will purchase less shares as the market rises and more when it falls.

Since the tendency is that the market rises with the passage of time, these funds will increase, allowing for substantial savings compared to what might develop either a money market or standard savings.

-

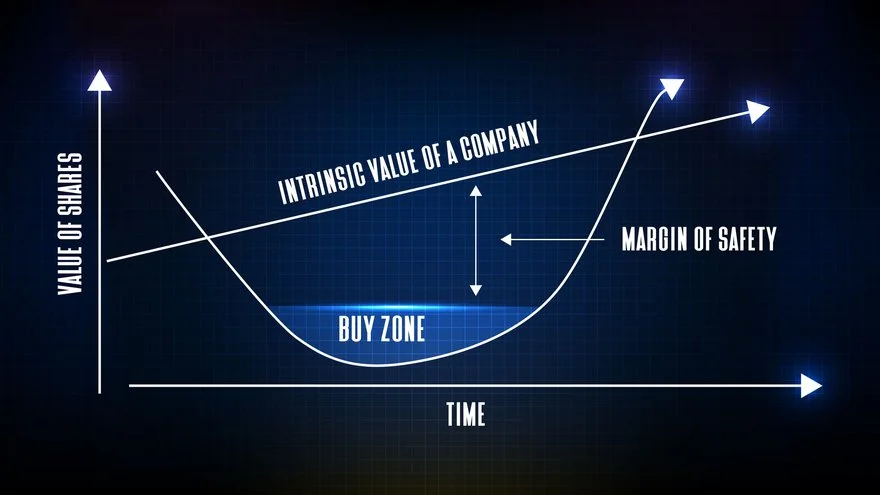

A “margin of safety”

The concept typically followed in the financial industry is to “buy low and sell high.” It sounds good on paper but implementing the tactic can prove tricky. How do you determine the low and the high?

“Intrinsic value” needs to be determined, but to do so, there needs to be considerable research on finding this value. The indication is that “value investors” will assess their idea of the intrinsic value and only buy stocks when the price point is substantially below that value. This is how they incorporate a “margin of safety.’

As an example – if the intrinsic value is perhaps $80 per share with the price point only $60 or below a share, that’s considered a 20% margin of safety. Each investor will carry their own margin of safety based on their comfort level and how they determine intrinsic value.

Final Thought

Regardless of the risk management strategy implemented, the priority is to ensure wealth is protected and loss is minimal. It is important to be defensive, but it’s also okay to take some risks.